WELCOME TO

MOSAIC BLACK

A bold new team structure powered by Real Brokerage. Built for agents who are serious about growth, community, and profitability.

Join forces with a dynamic community of agents revolutionizing cloud-based support. Connect meaningfully, access marketing that truly delivers, and be part of a network that empowers your success.

Why Mosaic Black

Curated Client Events

Mosaic Black plans and executes 3 client

appreciate events annually for your database

Monthly Mailers

Stay top of mind with our custom made mailers that are sent straight to your clients mailboxes every month on your behalf

Collaboration over Competition

Be part of a community that encourages growth and genuine community. Enjoy professional classes as well as opportunities to create genuine relationships through fun events and community outreach

FAQ

If I am part of Mosaic Black do I have to use Mosaic Black in my branding?

No, you can use your own personal branding.

Have additional questions?

Reach out to [email protected] or fill out the form below!

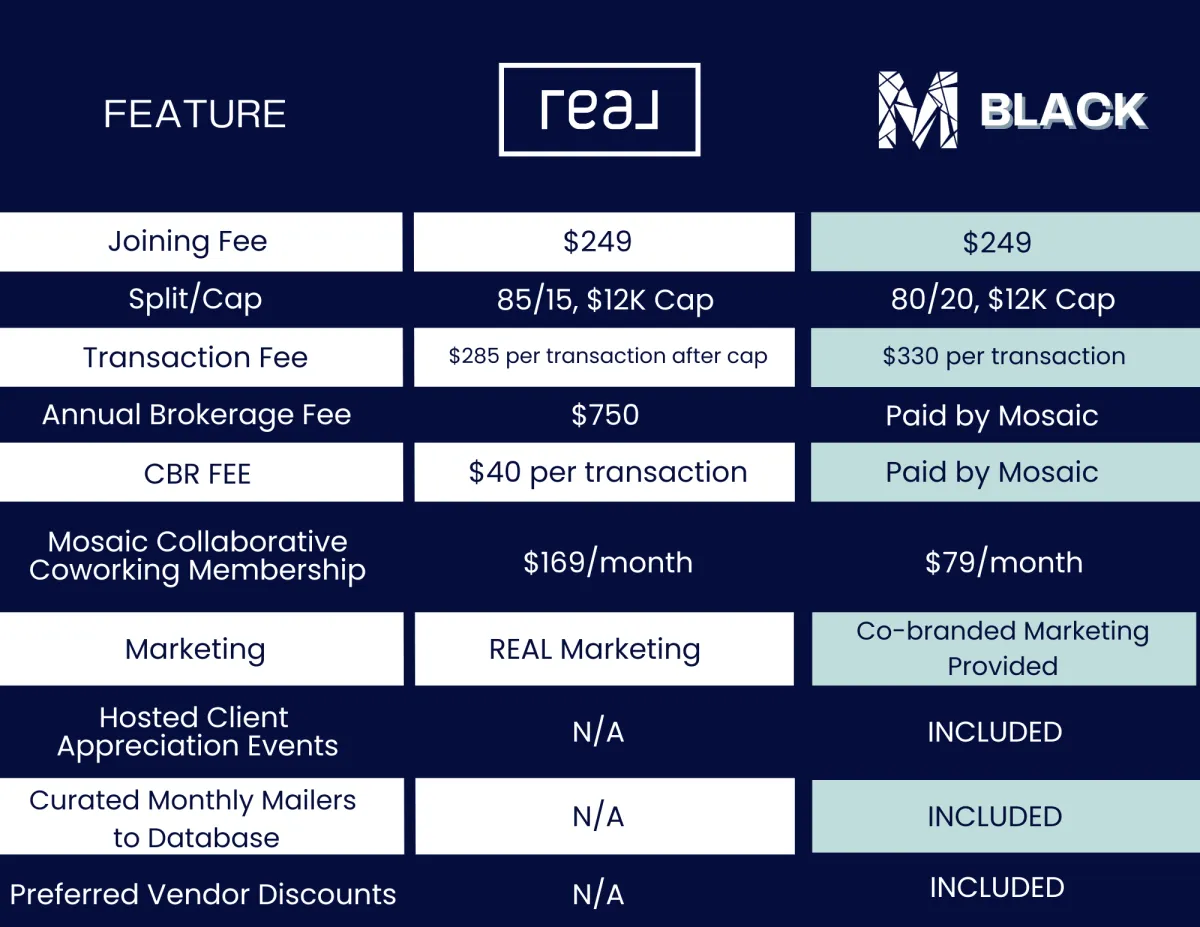

Pricing Breakdown

Have Questions?

Ready to Move Forward?

©2025 Mosaic Black - All Rights Reserved